richmond county va business personal property tax

If you have an issue or a question related to your personal property tax bill call RVA311 by dialing 311 locally visit. You have the option to pay by credit card or electronic check.

Business Tangible Personal Property Tax Return2021 2pdf.

. On Tuesday the council voted. WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the payments. Find Information On Any Richmond County Property.

Forty-five of Virginias 95 counties. Business Tangible Personal Property Tax Return Richmond. Vagas Jackson Tax Administrator 1401 Fayetteville Rd.

Tweet this Tangible property includes machinery and equipment furniture and fixtures of non-manufacturing businesses certain computer hardware trucks and automobiles and any other tangible property used in a business unless specifically exempted. Rockingham NC 28379 Business. Fax Numbers 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours.

Business Personal Property Registration Form An ANNUAL filing is required on all business personal property items located in Richmond County as of January 1 st of each tax year. Richmond County collects on average 045 of a propertys assessed fair market value as property tax. Department of Finance 4301 East Parham Road Henrico VA 23228.

It is estimated that by freezing the rate the city will provide Richmonders more than 8 million in additional relief. There is a convenience fee for these transactions. Depending on your vehicles value you may save up to 150 more because the city is freezing the rate.

Richmond County has one of the lowest median property tax rates in the country with only two thousand nine of the 3143 counties collecting a lower. Farmers and business owners are required to attach an itemized list of all. Business Personal Property Taxes are billed once a year with a December 5 th due date.

The median property tax in Richmond County Virginia is 673 per year for a home worth the median value of 148700. You can make Personal Property and Real Estate Tax payments by phone. For Personal Property Tax Payments Feel free to contact the office should you have any questions 804-333-3555.

Ad Find Richmond County Online Property Taxes Info From 2022. Only tangible business personal property is taxed. Box 90775 Henrico VA 23273-0775.

Finance Main Number 804 501-4729.

Virginia Property Tax Calculator Smartasset

Virginia Property Tax Calculator Smartasset

Native American Gaming And Casino Gambling In Virginia

Frpo 2020 Directory By Mediaedge Issuu

Virginia Property Tax Calculator Smartasset

Henrico County Personal Property Tax Bills Due Friday Wric Abc 8news

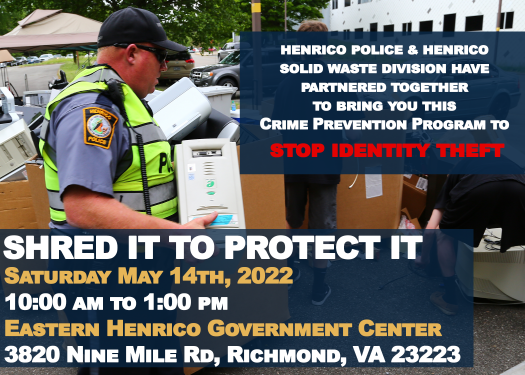

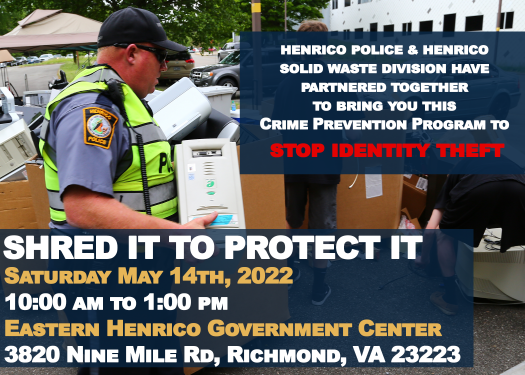

Shred It To Protect It Henrico County Virginia

Personal Property Tax And Exemptions Augusta County Va

Economic Development Mecklenburg County Va

Gop S Youngkin To Call For Billions In Tax Cuts In His First Extensive Policy Proposal Of The Virginia Governor S Race The Washington Post

Four Richmond County Deputies Arrested For Smuggling Jail Sweep Turns Up Phones Weapons And Drugs The Augusta Press

/cloudfront-us-east-1.images.arcpublishing.com/gray/WPM3BLSOYBGB7DP3Q4DS2QXRUU.png)

Chesterfield Provides Grace Period On Personal Property Tax Payments

2020 2021 Membership Directory By Greater Kitchener Waterloo Chamber Of Commerce Issuu

Four Richmond County Deputies Arrested For Smuggling Jail Sweep Turns Up Phones Weapons And Drugs The Augusta Press